Some Ideas on Feie Calculator You Need To Know

Table of ContentsThe Definitive Guide to Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.Feie Calculator Things To Know Before You Get This5 Simple Techniques For Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Discussing

US deportees aren't limited only to expat-specific tax breaks. Often, they can claim a lot of the same tax credit ratings and deductions as they would certainly in the US, including the Kid Tax Obligation Credit Score (CTC) and the Life Time Discovering Debt (LLC). It's feasible for the FEIE to reduce your AGI a lot that you do not qualify for certain tax obligation credit scores, though, so you'll require to verify your eligibility.

The tax code says that if you're an U.S. person or a resident alien of the USA and you live abroad, the internal revenue service tax obligations your around the world earnings. You make it, they strain it despite where you make it. Yet you do get a great exclusion for tax obligation year 2024.

For 2024, the maximum exemption has been enhanced to $126,500. There is also an amount of certified real estate expenses qualified for exclusion.

The Basic Principles Of Feie Calculator

You'll have to figure the exclusion first, due to the fact that it's limited to your foreign earned earnings minus any kind of foreign real estate exclusion you claim. To get approved for the international earned earnings exclusion, the international housing exclusion or the international real estate reduction, your tax obligation home must remain in an international country, and you need to be among the following: A bona fide homeowner of an international nation for an uninterrupted duration that consists of a whole tax obligation year (Authentic Resident Examination).

for a minimum of 330 complete days throughout any period of 12 successive months (Physical Visibility Test). The Bona Fide Local Examination is not applicable to nonresident aliens. If you declare to the international government that you are not a local, the examination is not satisfied. Qualification for the exemption could additionally be impacted by some tax treaties.

For U.S. residents living abroad or earning earnings from foreign sources, inquiries commonly develop on exactly how the U.S. tax obligation system applies to them and just how they can guarantee compliance while decreasing tax liability. From understanding what foreign earnings is to browsing different tax return and deductions, it is very important for accountants to understand the ins and outs of U.S.

Jump to Foreign income is defined as any revenue gained from resources outside of the United States. It encompasses a variety of economic activities, including yet not limited to: Salaries and earnings made while functioning abroad Rewards, allocations, and advantages provided by international companies Self-employment income obtained from international organizations Passion gained from international checking account or bonds Dividends from foreign corporations Resources gains from the sale of international assets, such as realty or stocks Profits from renting international residential properties Earnings generated by foreign services or collaborations in which you have a rate of interest Any other earnings made from foreign sources, such as royalties, alimony, or betting payouts International gained earnings is defined as earnings made via labor or solutions while living and operating in an international nation.

It's critical to identify foreign made income from various other sorts of foreign revenue, as the Foreign Earned Earnings Exemption (FEIE), a useful U.S. tax advantage, particularly puts on this category. Investment earnings, rental earnings, and passive earnings from international resources do not qualify for the FEIE - Foreign Earned Income Exclusion. These sorts of income might go Find Out More through various tax treatment

resident alien who is a citizen or nationwide of a nation with which the United States has a revenue tax obligation treaty in impact and who is a bona fide citizen of an international country or nations for an undisturbed duration that consists of a whole tax year, or A united state citizen or a UNITED STATE

Fascination About Feie Calculator

Foreign gained revenue. You must have gained earnings from work or self-employment in an international country. Passive earnings, such as interest, rewards, and rental revenue, does not get approved for the FEIE. Tax obligation home. You must have a tax obligation home in a foreign nation. Your tax obligation home is usually the area where you conduct your normal organization tasks and preserve your key economic passions.

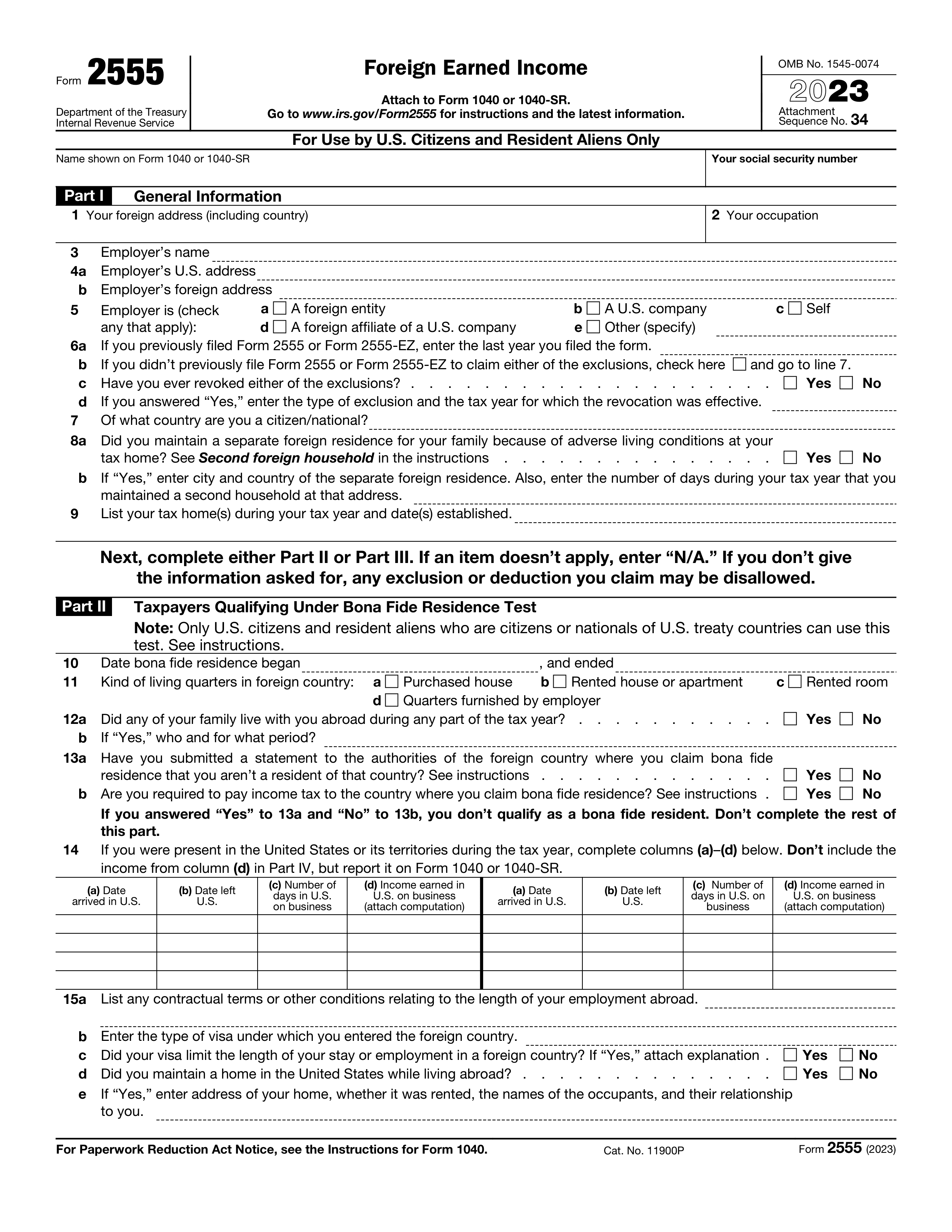

This credit report can counter your United state tax obligation liability on foreign earnings that is not eligible for the FEIE, such as investment earnings or passive income. If you do, you'll after that file additional tax obligation forms (Kind 2555 for the FEIE and Form 1116 for the FTC) and attach them to Type 1040.

8 Easy Facts About Feie Calculator Shown

The Foreign Earned Earnings Exemption (FEIE) permits qualified people to omit a section of their international gained income from U.S. tax. This exemption can considerably lower or get rid of the U.S. tax obligation obligation on international earnings. The specific amount of international revenue that is tax-free in the U.S. under the FEIE can alter yearly due to inflation modifications.